MetaTrader 5 is a fully integrated, multi-asset trading platform designed for brokers launching a new business or scaling an existing one. It enables you to deliver professional brokerage services across Forex, equities, and futures markets from a single institutional-grade system.

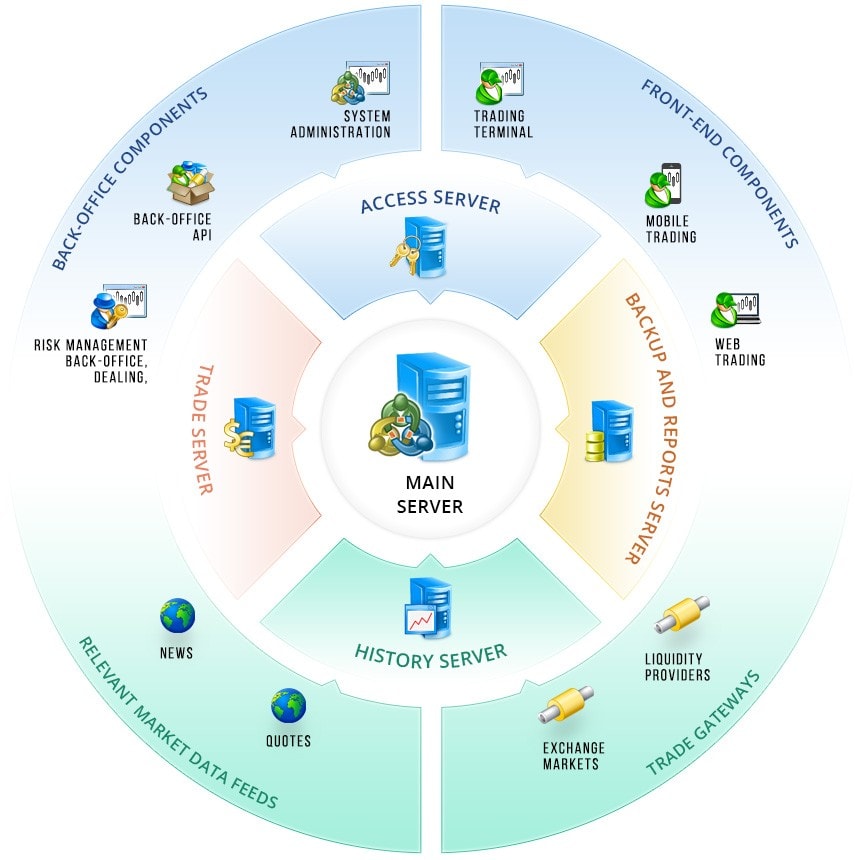

MetaTrader 5 is a full-cycle system featuring every core component required to operate a modern brokerage. The flexibility, ease of use and device compatibility are provided through the advanced trading components, which include the desktop, mobile and web terminals. MetaTrader 5 supports White Label licensing, provides enhanced back-office functionality, connectivity to exchanges and liquidity providers, and comprehensive APIs for integration with your website, trading infrastructure, and post-trading systems.

A True Multi-Asset Trading Platform

Start a brokerage business with MetaTrader 5, and provide traders with a robust, modern platform for trading across major financial markets. The platform supports the netting position accounting system for exchange traders and the hedging option for full-fledged Forex trading. A flexible trading environment with Market Depth and support for all order types enables traders to execute virtually any strategy with precision.

Beyond the outstanding trading functionality, MetaTrader 5 delivers professional technical and fundamental analysis tools for all asset classes supported. The platform ecosystem also fully supports algorithmic trading, copy trading, and social trading models.

Advanced Back-office and Business Control

The MetaTrader 5 ecosystem is engineered to ensure maximum operational flexibility for your business. Extensive configuration options allow the platform to be tailored precisely to your business model, regulatory requirements, and growth strategy.

The platform supports multiple business models simultaneously and offers granular, role-based access control for staff such as administrators, accountants, dealers, and risk managers. Brokers retain full control over trading conditions, including margin requirements, contract specifications, credit limits, swaps, trading sessions, spreads, markups, commissions, and other parameters.

Built-in preventive risk management mechanisms continuously monitor technological, financial, margin, and operational risks before they escalate. MetaTrader 5 provides a broad set of tools for managing risk across all asset classes, ensuring compatibility with different brokerage models and compliance frameworks.

Operational and regulatory requirements of the dealing desk can be fully configured within the system. The platform infrastructure is built to support flexible access levels, multi-dealer workflows, segmented client groups, and real-time supervision of open positions, orders, and incoming requests — all from a centralized interface.

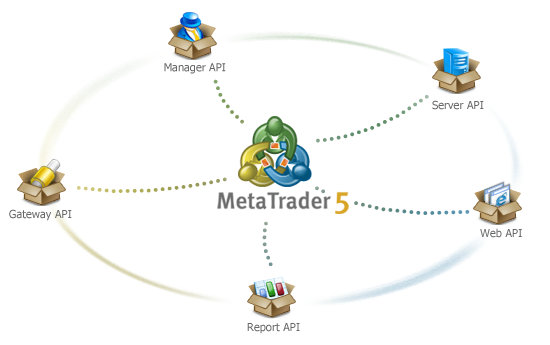

MetaTrader 5 APIs help to further extend platform capabilities, allowing brokers to customize components, expand functionality, or integrate the platform with proprietary trading, CRM, and post-trade systems.

Liquidity Access via Ultency

MetaTrader 5 includes a built-in solution for liquidity aggregation and order matching through Ultency. Brokers gain access to more than 30 liquidity providers, including tier-one banks and leading global brokers. Ultra-efficient connectivity protocols and deployment in top-tier data centers allow the platform to achieve ultra-low latency of up to 0.1 ms.

To find and connect a provider, simply log in to MetaTrader 5, where a marketplace of ready-to-use solutions is available with detailed descriptions of trading conditions. You can contact the provider via the built-in communication system, clarify the required details, and sign an agreement. After receiving your login credentials, you configure the connection and start trading. The entire process is fast and straightforward. With Ultency, you can launch a new brokerage business or expand an existing one in the shortest possible time.

In addition, MetaTrader 5 supports direct connectivity to global exchanges through dedicated gateways, providing maximum control and flexibility for brokerage operations.

Integrated Payment System

MetaTrader 5 allows traders to fund their accounts directly within the trading platform, without additional authorizations or workflow interruptions. This creates a seamless and secure funding experience that keeps traders focused on the market. Integration with a wide range of payment providers gives clients access to more than 50 deposit and withdrawal methods, including bank transfers, cards, e-wallets, and local payment systems.

Benefits for your business:

- Faster onboarding and higher conversion rates. Traders can download the trading platform, open an account, make a deposit, and begin trading immediately — no separate website account required.

- Lower operational costs. You avoid the expense of building and maintaining your own payment processing infrastructure.

- Increased deposit volumes. Without the need to switch between windows or perform additional authorizations, traders can respond more quickly to favorable market conditions. These leads to increased engagement and trading activity.

Accounts can be funded via bank transfer, bank card, or supported payment systems.

Automations of Brokerage Operations

The Automations service eliminates manual workflows and reduces operational overhead. By removing the human factor from day-to-day processes, you free up internal resources for higher-value tasks, reduce operational risk, and lower ongoing costs.

Brokers define triggers and automated scenarios within the platform. For example: a client registers — a welcome email is sent; a trader reaches a predefined volume — a bonus is credited. Automation reacts instantly to events and executes scenarios accurately and consistently.

The system supports thousands of automated scenarios to free your team from repetitive tasks:

- Client communications and marketing activities

- Platform maintenance and configuration management

- Trade and account lifecycle management

Performance and Security

MetaTrader 5 delivers exceptional performance, supporting high trading volumes while reducing infrastructure requirements. It is widely recognized as one of the fastest, most efficient trading platforms in the industry.

The platform is built on a distributed architecture, with system functions separated across multiple servers. This removes architectural limitations and allows performance to scale linearly by deploying more servers within the platform. Even during rapid business growth, service quality and operational control remain uncompromised.

Distributed architecture also enhances cyber-resilience. Trade servers can be protected behind multiple access points which absorb malicious traffic while core systems continue to operate normally and data remains secure.

The trading platform provides a reliable security system. All communications between system components are encrypted. Modern authentication and authorization mechanisms protect client accounts, while all system databases are encrypted and support backup and recovery procedures.

We understand the importance of data protection and that is why the platform is deployed on your own infrastructure. You retain full control over servers, administration, and support. MetaQuotes does not provide SaaS solutions and has no access to servers, accounts, or trading data. Data security and client privacy remain fully under your control and aligned with the latest industry standards.

Flexible Licensing Policy

MetaTrader 5 offers a flexible licensing structure to accommodate any business model, trading volumes, operational scale, and any long-term growth strategy.