3 December 2020

New MetaTrader 5 for Hedge Funds — fast and efficient infrastructure out of the box

MetaQuotes

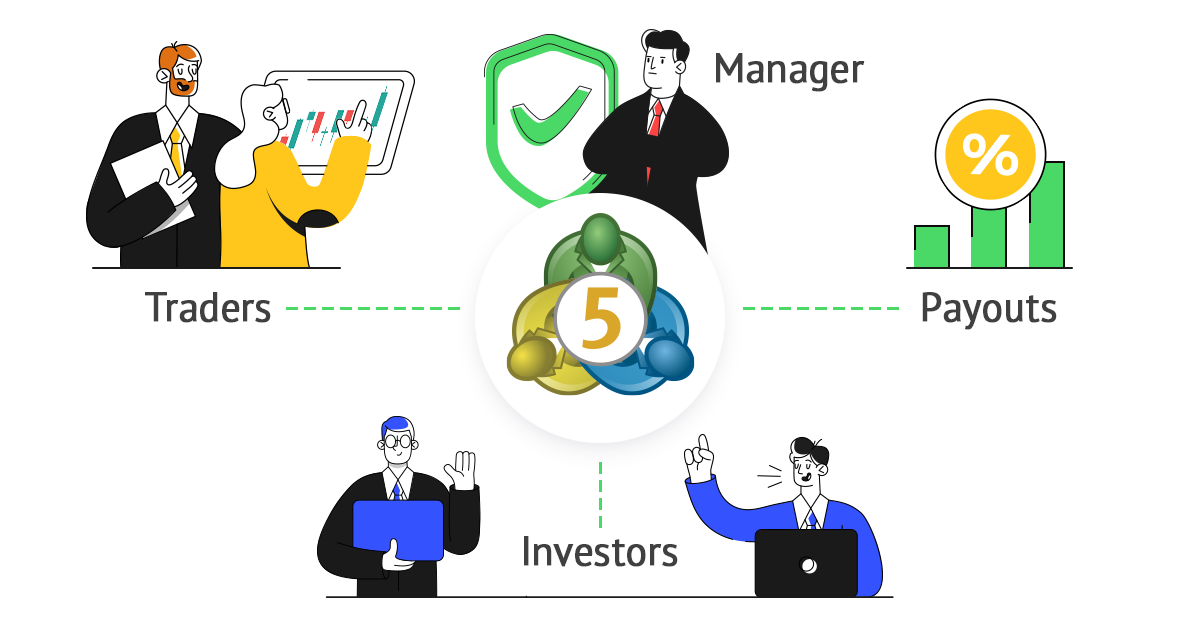

MetaTrader 5 platform offers a turnkey solution for mutual funds, prop trading and investment companies right out of the box. Create a fund, configure payouts and commissions, add fund managers and open investor accounts directly from MetaTrader 5 Administrator.

All calculations related to share values, profitability and payouts are performed automatically in real time. Fund clients are able to monitor their investments and buy additional shares directly from the MetaTrader 5 client terminal like ordinary traders.

MetaTrader 5 makes fund creation simple

Our platform saves start-up companies and brokers from the costs of deploying their own investment business infrastructure. MetaTrader 5 Administrator features all the necessary tools for arranging a fund and a prop company, including trading accounts, client groups, financial symbols and connection to exchanges.

Organizational and legal issues of a business startup remain the client's only concern. All the technical aspects are covered by the platform itself.

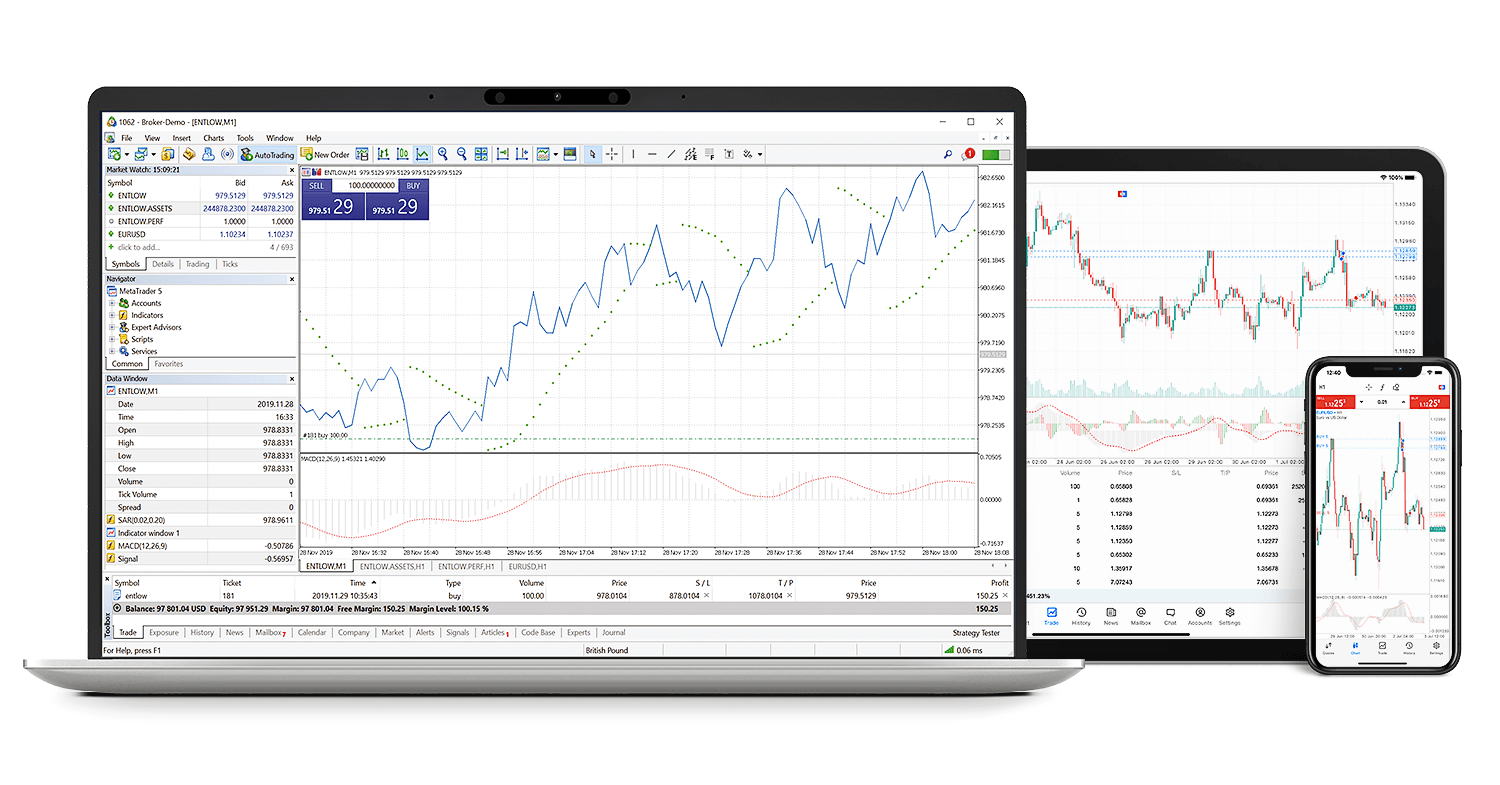

One terminal for trading all symbols — a fund manager's dream come true

MetaTrader 5 is able to connect to over 80 exchanges all over the world using gateways. They allow the passing of trade operations to external systems, while they also allow the transmission of quotes and news from them. Our gateways are easy to manage: control and re-structure your business, manage risks, generate reports, receive quotes and withdraw money.

Simply connect the required exchanges and popular liquidity providers, create and customize trading symbols and start trading. A unified system of accounting for trading operations allows a fund manager to control current risks and see all trading positions on one screen right in the client terminal.

Powerful environment for developing and testing algorithmic trading strategies

With MetaTrader 5, an investment company is able to compete with the world's most famous funds in terms of technology.

MQL5 language for developing trading strategies is tailored specifically for working on financial markets and provides algorithmic traders with the widest of opportunities:

- Math libraries — neural networks, solving differential equations, Fourier transform, numerical integration, optimization problems, fuzzy logic and much more.

- Network functions — data search, exchange and delivery within the network.

- Integration with Python — machine learning, analysis and statistics libraries.

- OpenCL support for parallel computing.

- DirectX functions for data visualization in 3D charts.

- Native handling of SQL databases.

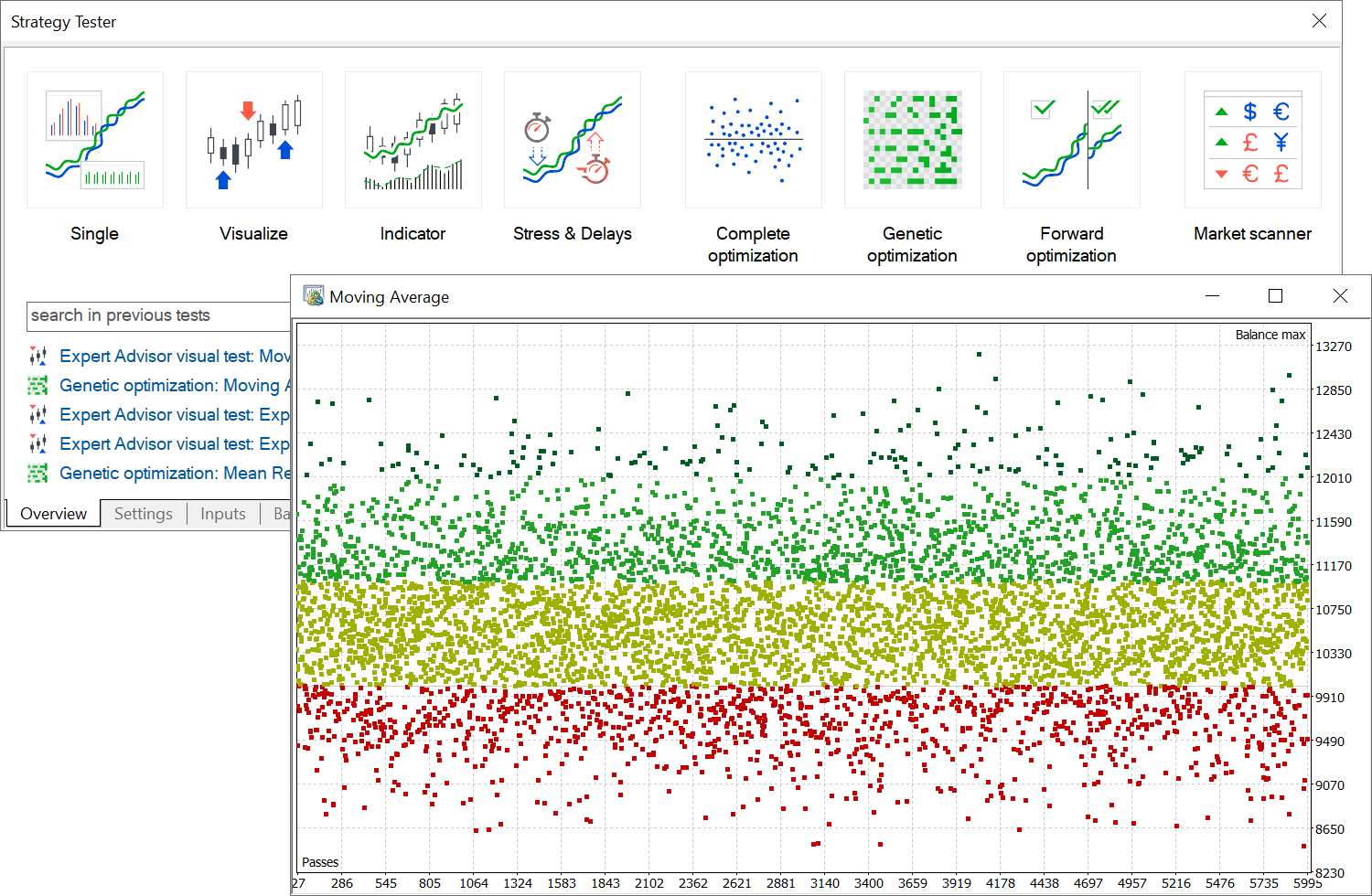

Furthermore, your fund managing traders can optimize trading robots using the built-in strategy tester, which enables access to the MQL5 Cloud Network — a large-scale cloud network with tens of thousands of test agents which are able to solve optimization problems within an hour. Solving such problems on a regular computer normally takes months of computing time.

As a result, traders get a synergistic effect: all trading instruments are not only traded in one client terminal, but also all trading strategies are developed in one specialized language and tested in a multi-threaded multi-asset tester using the computing resources of several thousand computers from the MQL5 Cloud Network.

Investors obtain convenient trading terminals for working with funds

MetaTrader 5 platform allows the build up of trusting relationships with investors — clients always know about their invested funds status and are able to contact you, if they wish to alter their investment. You remain in constant contact with clients — each investor can log into his or her account using a desktop or mobile terminal and check current status. There is no need for additional requests and other complications — all indicators are displayed on comprehensive charts.

Full automation of calculations and flexible settings

Automate your work flow: set up separate access for your employees and investors, monitor the work of your team members and generate performance reports. Adjust payouts based on rates, on commissions, on payment methods or on any other conditions. Set individual properties for each fund: requirements for investors, for financial instruments, for settlement methods, for capitalization, for share values, etc.

USD 10,000 for the ready-made tool

Purchase this functionality suite for arranging an investment business for only USD 10,000 for connecting to the platform + USD 2,000 monthly license fee.

Features which you will obtain out of the box:

- Free installation and training.

- Technical support — online chat, hotline, detailed documentation and other useful materials.

- Access to back office APIs for enhancing functionality and usage of all platform features.

- Auto updates.

Request access to MetaTrader 5 for hedge funds

- MetaQuotes Software is 20!

- MetaQuotes Software is a Platinum Sponsor of The Forex Expo Dubai 2020

- MetaTrader 5 wins Best Multi-Asset Trading Platform and Best FX Trading Platform at Finance Magnates Awards 2020

- MetaTrader 5 build 2690: Market depth for all instruments and enhanced code profiler

- Uniglobe Markets launched MetaTrader 5 for Indices, Futures and Stock trading