12 May 2017

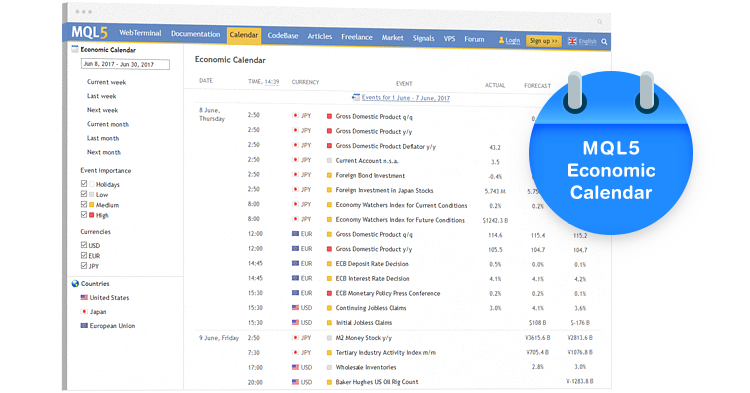

Economic Calendar: already available on MQL5.com, coming soon in MetaTrader 5

MetaQuotes

A new service has been launched on MQL5.com — the economic calendar tool is intended to provide useful information about macroeconomic events. It is considered a major fundamental market analysis tool developed by MetaQuotes Software on the bases of real-time data collected from public sources.

The current version features economic news from the US, Japan and the European

Union. Regardless of the broker used, relevant

information is delivered to traders without delays, allowing them to instantaneously react to market events.

Soon, the new calendar will replace the current one used in MetaTrader

5, so that users of the multi-asset platform will be able to receive

up-to-date indicator values immediately after their release. Moreover, it

will be possible to access the economic calendar from MQL5 robots and

the strategy tester.

The

MQL5.com economic calendar provides an online chronology, in which

events are marked in accordance with their significance, while the most

important ones are shown with a red label. With the economic

calendar, you can keep track of key events and evaluate their effect on

financial markets. Information about economic indicator releases can

help users to formulate informed trading decisions and forecast future

market developments. For example, knowing the release time of GDP or

unemployment rate reports, you can prepare for increased volatility

in the market to capture good trading opportunities.

With the

MQL5.com

economic calendar, you can always be up to date on global markets and

well prepared for market movements. For convenience, you can filter

events by

importance, choose desired countries and time intervals. This essential

economic information resource is updated automatically during

announcements in

real time.

Open the economic calendar right now, and start monitoring important macroeconomic events to make more weighted trading decisions.

- MetaQuotes Software to participate in the iFX EXPO International 2017 Expo

- Plugit Apps makes their brokerage solutions MetaTrader 5 compatible

- MetaTrader 5 trading platform is now available for AMP Futures clients wanting to trade futures

- MetaQuotes Software opens its new office in Bulgaria

- MetaQuotes Software will participate in Moscow Financial Expo 2017